HSA/FSA Services

If you’re in the Inland Empire, Temecula, Orange County, or Irvine, you might be able to use your HSA/FSA to save on i-thriv mobile massage and in-home wellness services—and many people don’t realize they qualify.

With our partner Truemed, you can quickly find out if you’re eligible. A licensed practitioner reviews your wellness needs and determines if you qualify for a Letter of Medical Necessity (LMN).

If approved, you can use pre-tax HSA/FSA dollars on services like:

• mobile massage

• in-home wellness

• workplace wellness

• vibroacoustic therapy

We keep it simple —you focus on feeling better, and we’ll help you check eligibility and use your benefits correctly.

Your wellness should be accessible. If you qualify, Truemed helps make that possible.

Truemed is for eligible customers. Savings vary.

Learn more: truemed.com/disclosures

Checking out with Truemed is easy!

-

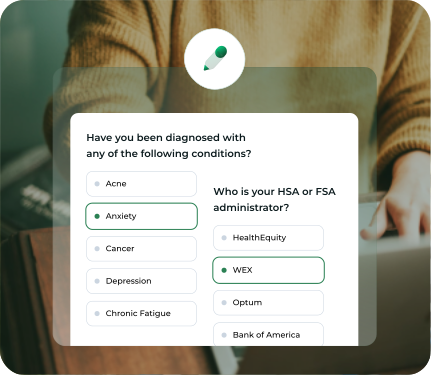

Complete Health Assessment

Pre-tax dollars

Take a quick, private health survey. A licensed provider will review your answers to determine eligibility. If eligible, you'll receive a Letter of Medical Necessity (LMN) within 1-2 days. -

Make your purchase

Pre-tax dollars

Do not pay with an HSA/FSA card during checkout. -

Submit for HSA/FSA reimbursement

Pre-tax dollars

If you qualify, you'll receive an LMN and a guide on how to submit your purchase to your HSA/FSA administrator for reimbursement. Claims are typically paid out in 1-2 weeks.

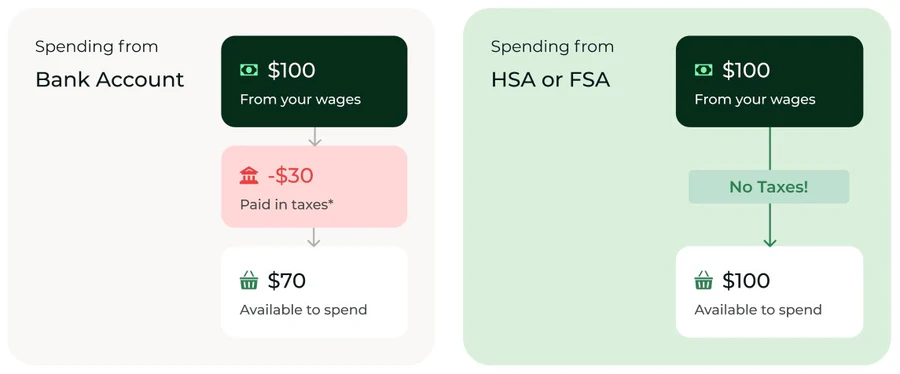

How does using my HSA/FSA save me money?

HSA/FSA accounts were created so individuals could use pre-tax money to pay for expenses used to treat, mitigate, or prevent a diagnosed medical condition.

Because HSA/FSAs use pre-tax money, you’re getting more purchasing power for your dollars. Rather than pay taxes on income and then spend it on health items, qualified customers can use pre-tax funds to invest in root cause interventions.

Who is Truemed?

At Truemed, we believe that investing in your health is far more valuable than waiting to spend on sickness. By unlocking pre-tax HSA/FSA spend on research backed interventions such as fitness, supplements, and health technology, we’re shifting healthcare spend toward true medicine.

What Services May Be Eligible with Truemed?

With a Truemed LMN, some i-thriv services may be HSA/FSA-eligible—depending on your health needs and plan.

You may qualify if you use our services for:

In-home mobile massage

Stress + tension relief

Recovery or pain management

Workplace wellness support

A licensed practitioner (through Truemed) reviews your concerns and decides eligibility.

Not everyone or every service will qualify—but many people do.

If you’re in the Inland Empire, Temecula, Orange County, Irvine, this could help you save on the wellness care you already need.

Want to see if you qualify? We can help you check in minutes.

Eligible Services

Common Questions

-

HSA and FSA dollars are pre-tax, meaning you can save up to 30% on eligible wellness services when you use approved funds.

-

They are tax-advantaged accounts that let you use pre-tax money for qualified health and wellness expenses.

HSA: Health Savings Account

FSA: Flexible Spending Account

-

Yes—if you qualify through Truemed and receive a Letter of Medical Necessity (LMN). Only approved clients can use HSA or FSA funds for eligible services.

-

Yes. You can always use a standard debit or credit card at checkout if you prefer.

-

A Letter of Medical Necessity (LMN) is a document written by a healthcare professional stating that certain wellness services support your health needs.

This allows your HSA/FSA funds to be used legally and compliantly. -

Truemed charges a small fee only if you are approved for an LMN. There is no fee if you're not approved.

-

Anytime during the year—especially before the FSA deadline since many FSAs are use-it-or-lose-it.

-

Most clients receive their LMN within 1-3 days after completing the qualification form.

-

No, Truemed works only with U.S.-based HSA and FSA accounts.